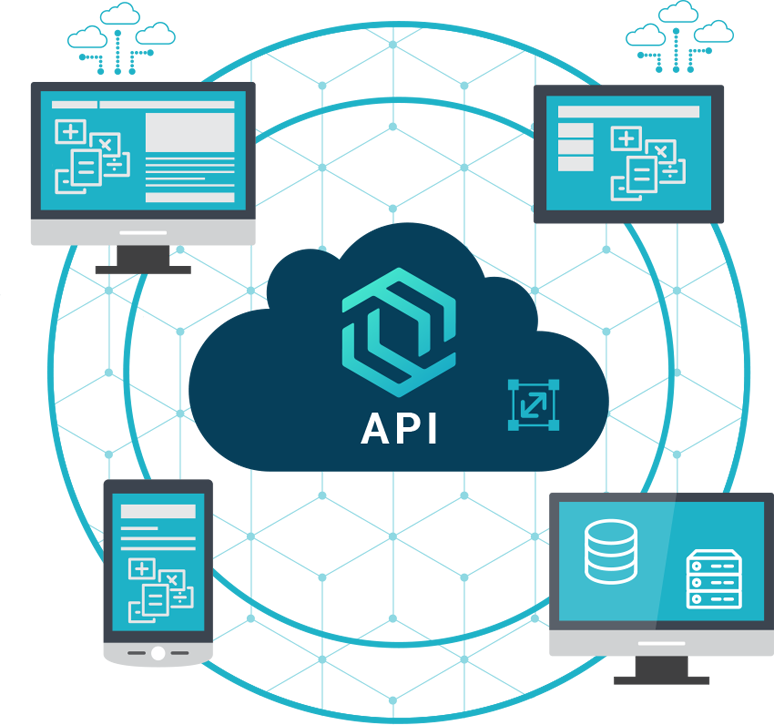

Finbotx’s powerful quantitative modeling engine is made available via web API services.

This allows for central usage of Finbotx’s modeling suite from any device, application and operating system. Clients benefit from this setup as new developments and regulations will be made centrally available. Additionally, clients can use the same Finbotx modeling suite in their mobile apps, e-banking, reporting system, portfolio management system, on-boarding tool, etc., ensuring both consistency and cost effectiveness.

The API service is well documented and provides full calculation examples. This allows front-end developers to quickly see and test out the API responses linked to their portfolios and clients. The calculation servers can scale up the computational resources at the server end, providing a fast and stable performance of the calculations irrespective of the device used and number of analyses done by web API service.

Security

The Finbotx modeling suite does not require any customer identifiable data; this is all stored in your own database. In order to make a request to the calculation engine, you send in anonymized portfolio data to the engine, after which it returns its results. And after the session, even the anonymized data is removed from the Finbotx servers.

The cloud architecture of Finbotx is state of the art, and consists out of modern fire walls and authentication as well as load balancers and checkers to ward of any adversary requests.