Nationale-Nederlanden is a financial services provider offering products and services in the fields of insurance, pensions and banking to more than 6 million private and business customers in the Netherlands. Nationale-Nederlanden is part of NN Group, an international financial services provider active in 18 countries and leading in a number of European countries and Japan. NN Group N.V. is listed on Euronext Amsterdam (NN).

The discretionary portfolio management division of Nationale-Nederlanden Bank has won the Cashcow Award 2020 in the category ‘Best Online Asset Manager’ and has been rated with five stars by Finner. As to improve their service even further, they have now implemented the Finbotx Risk Profiler in their client onboarding process.

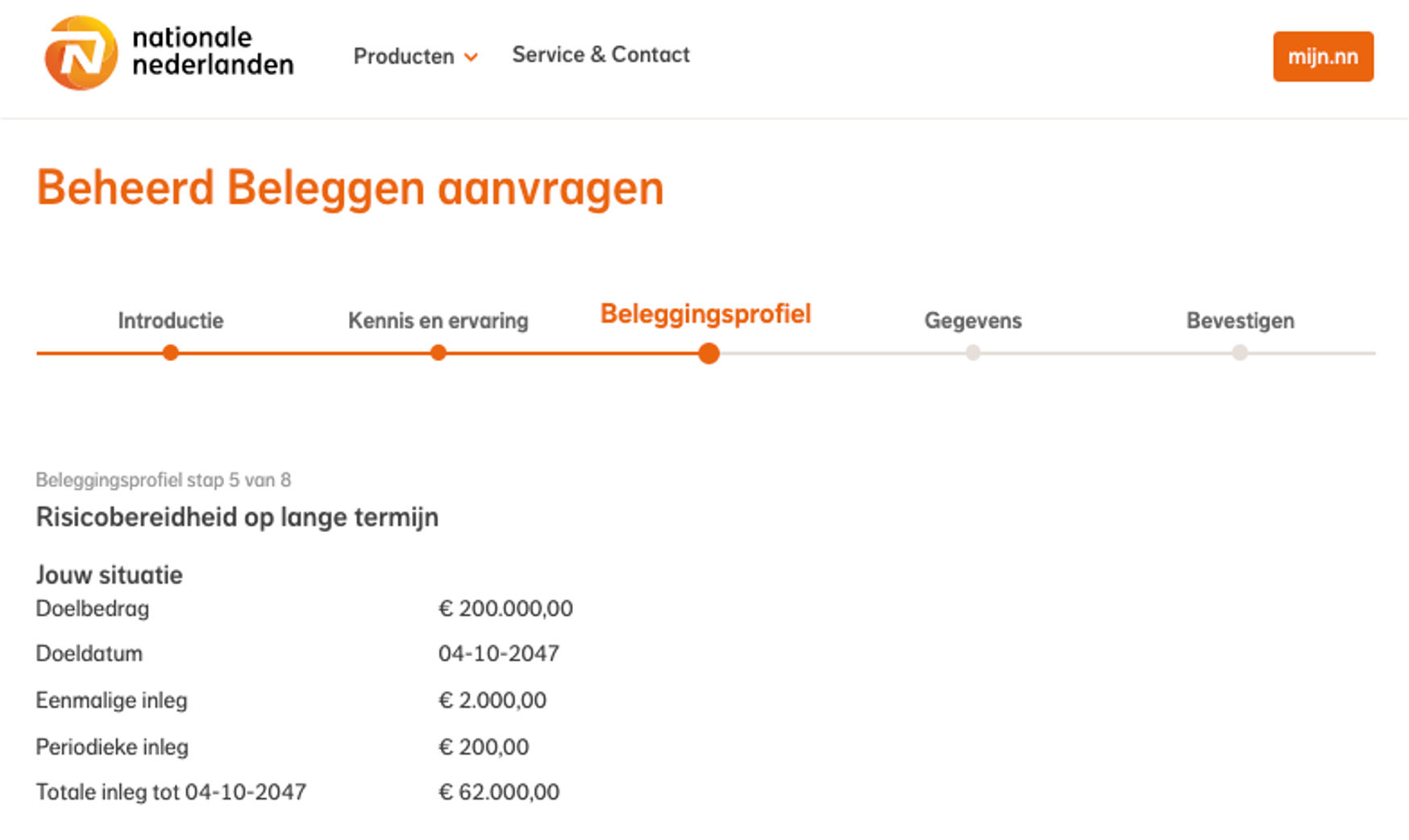

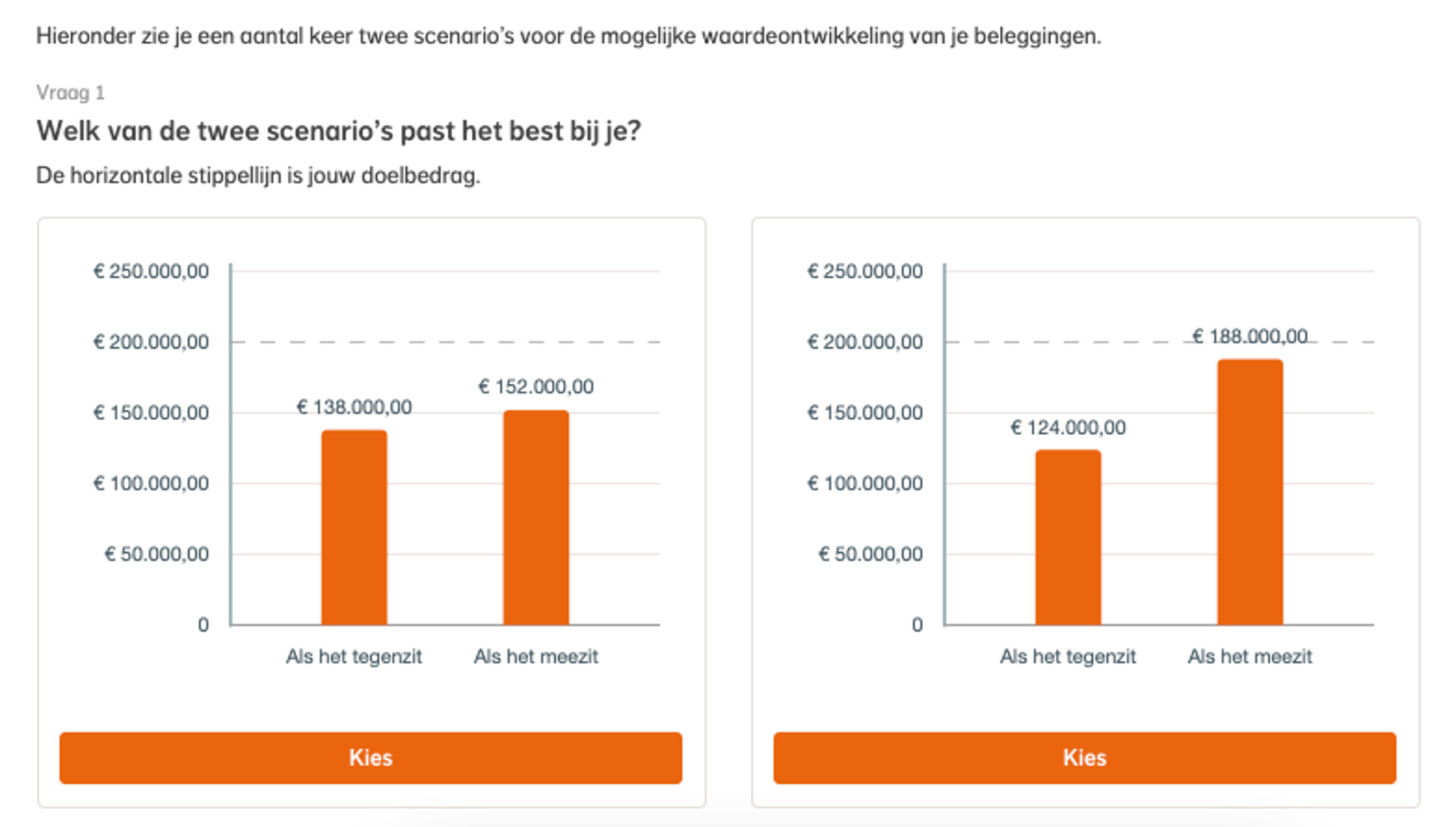

NN is constantly looking for ways to add value to their customers and as such, they find it important to infuse scientific advancements, for customers to make even better fitting investment decisions. Finbotx provides an AFM recommended method to do so; it calculates which risk profile yields the highest expected utility (happiness), which could be implemented smoothly in NN’s existing onboarding process due to Finbotx’ API.

When asked what challenges one of the largest financial institutions in The Netherlands faced, whilst working with a much smaller fintech as Finbotx, NN said: “Since Finbotx has extensive experience in the financial world, we found Finbotx to be well aware and adaptable to the time-consuming challenges we faced during the preparatory phase. Especially with answering and tackling risk related topics.”. They described working with Finbotx was experienced as “pleasant, knowledgeable and forthcoming” and the technical implementation as “smooth”.

“The functionality offered by Finbotx surpasses that of the larger well know players we have spoken to. This quality combined with more reasonable pricing makes Finbotx is the calculation engine of choice for the OAKK tool.”

Arthur Hopstaken, Partner – HJCO Capital Partners